Monte carlo retirement calculator excel

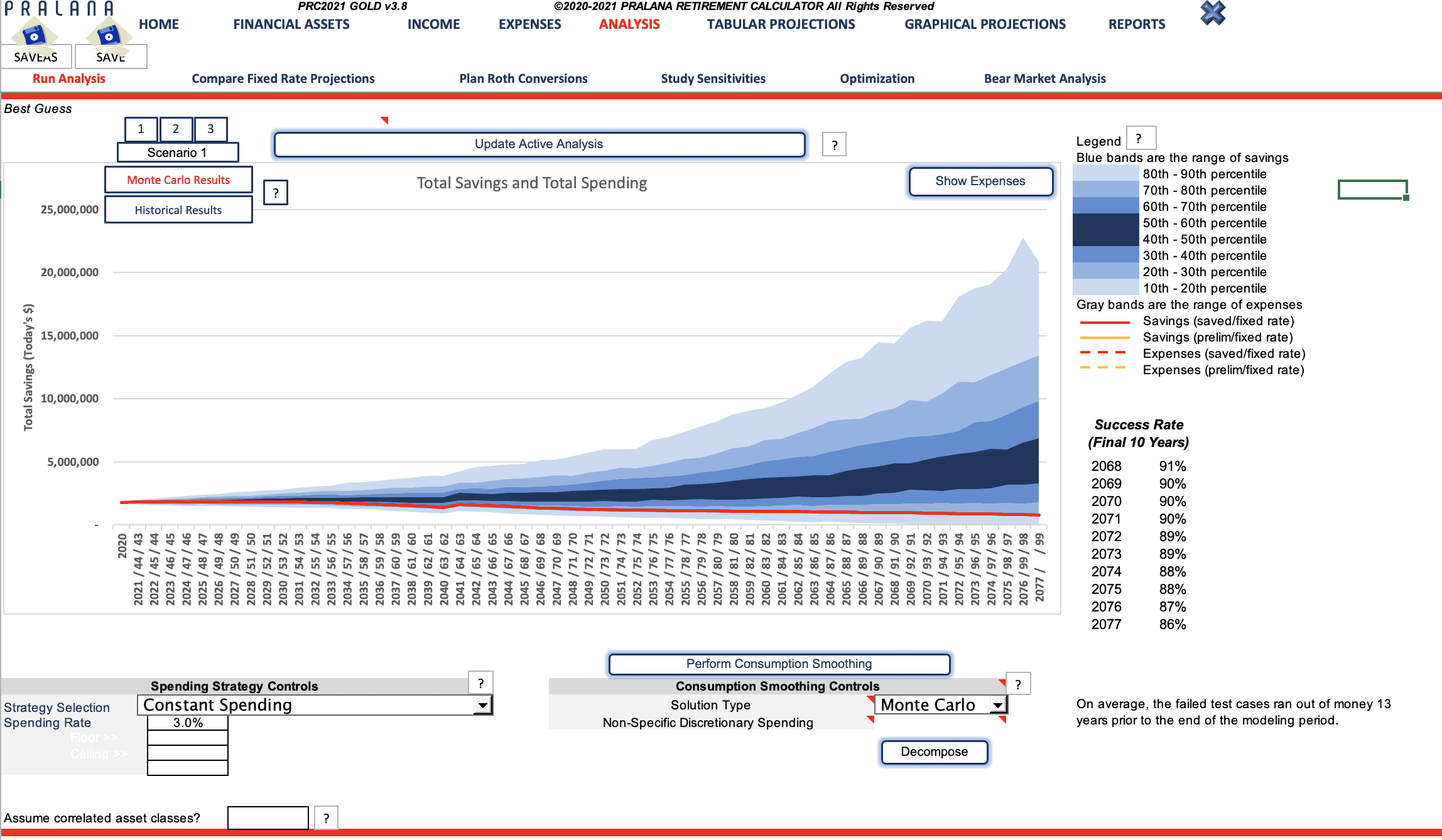

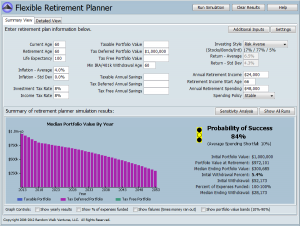

The retirement calculator runs 5000 Monte Carlo simulations to deliver a robust personalized retirement projection. Monte Carlo Retirement Calculator.

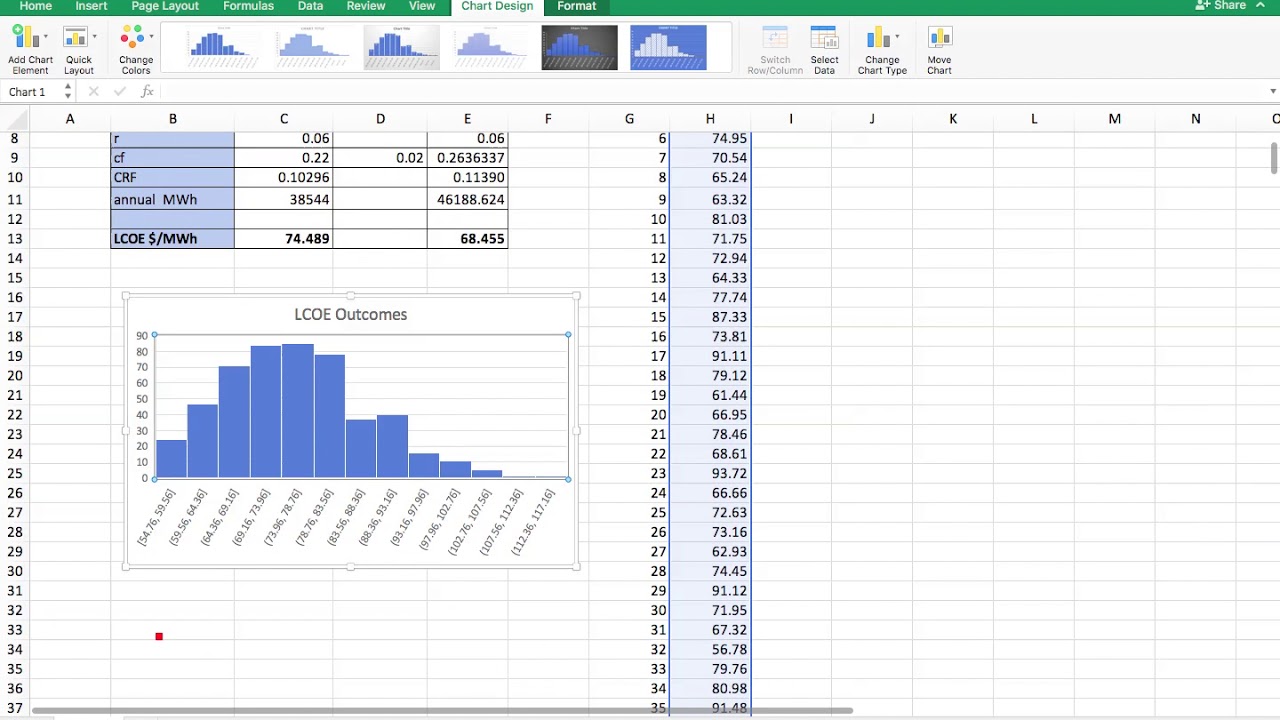

Lcoe And Monte Carlo Simulation In Excel 2016 Youtube

Compare your matched advisors for fees specialties and more.

. Retire in the early 1970s starting with 750000 and taking out 35000 each year and on average youll do just fine. But that average is meaningless. Working ROI Estimated annual return on investment during.

Approach retirementwith an informed investment income plan. The Best Free Monte Carlo Simulator. Check it out It took quite a lot of effort and testing to get it.

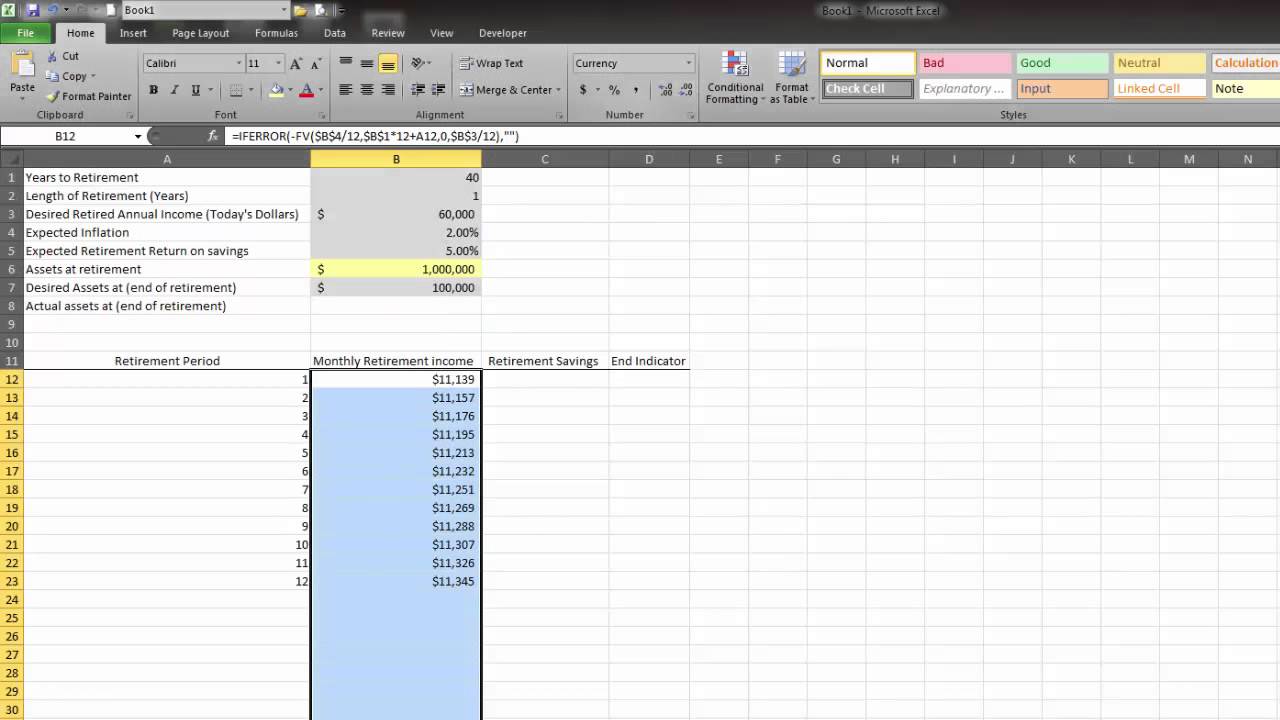

How many years should your savings last. FV rate of return periods years ongoing investment - initial investment FV 005 25 0 -1000 is 338635 We could equally easily get an answer for 1000 invested at 5. Retirement Portfolio Monte Carlo Simulation in Excel without Macros.

Ad Download the free Definitive Guide to Retirement Income for 500k portfolios. Heres a model I developed using Excel to simulation 1000 Monte Carlo scenarios for a retirement portfolio. The simulations incorporate expected return and volatility annual.

The three primary modes that are available in the early retirement calculator are. A market that averages. 1 constant single fixed-percentage real return rates 2 historical series of real returns are applied to.

This is user-friendly but thorough retirement calculator using Monte-Carlo Simulations. Try the simple retirement calculator. How much do you spend each year.

Ad Schedule a call with a vetted certified financial advisor today. Our Resources Can Help You Decide Between Taxable Vs. We take the number of scenarios where money never runs.

This is a tool that helps us deal with uncertainty in complex situations. About Your Retirement. Part 2 The inputs for this spreadsheet include.

45000 45 of savings. You provide your inputs starting balances on t. What is your savings balance today.

Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. As you build an income allocation plan for you and your family you will consider how your retirement income will look under three different results. This Monte Carlo simulation tool provides a means to test long term expected portfolio growth and portfolio survival based on withdrawals eg testing whether the portfolio can sustain the.

Shown here are the year. Our Monte Carlo retirement calculator runs 1000 scenarios where the rates of return for every investment changes in each year. Far and away my favorite online financial calculator to help you run Monte Carlo simulations on your portfolio is the Personal Capital.

It steps on the premise that. Monte Carlo simulation is one of the most famous and widely applied finance techniques.

3

Monte Carlo Simulation In Excel Retirement Savings Youtube

1

Retirement Calculation In Excel Youtube

The Best Retirement Planners Can I Retire Yet

3

Retirement Portfolio Monte Carlo Simulation In Excel Without Macros Part 1 Youtube

Finance With Excel Retirement Spending Calculator Youtube

Monte Carlo Simulation Formula In Excel Tutorial And Download

Basic Monte Carlo Simulation Of A Stock Portfolio In Excel Youtube

Early Retirement Calculator Spreadsheets Budgets Are Sexy

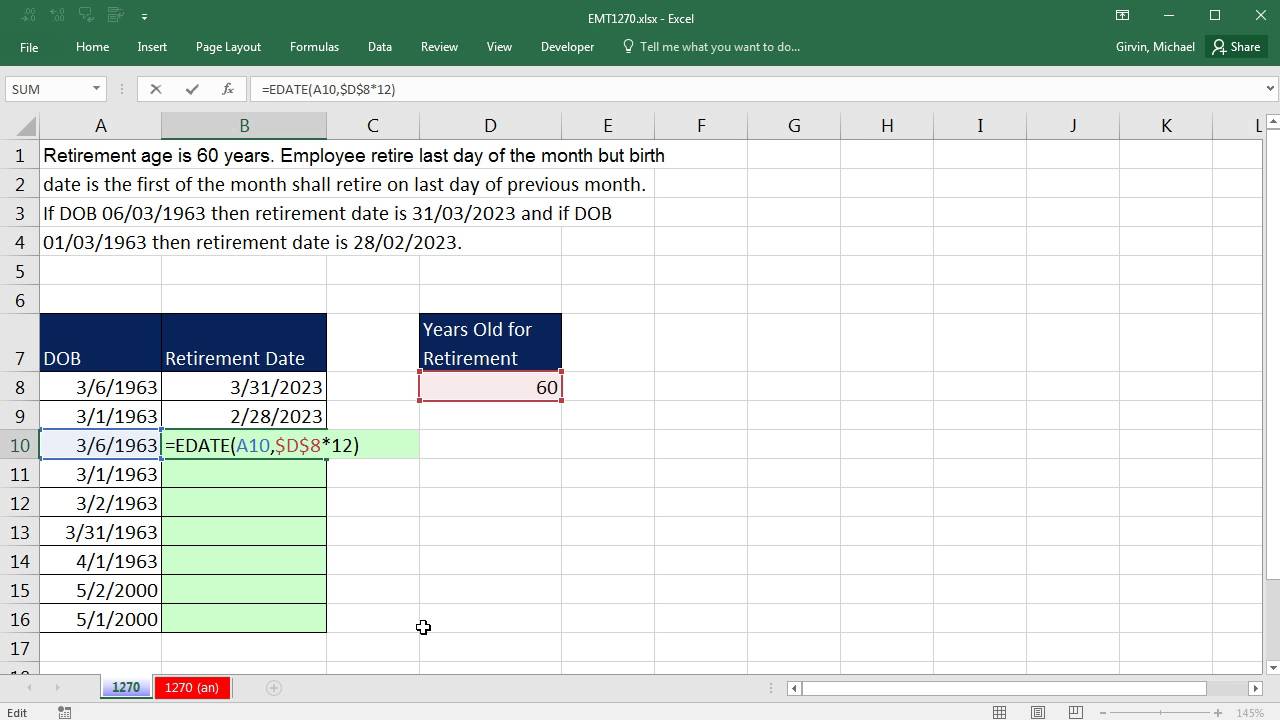

Excel Magic Trick 1270 Calculate Retirement Date With Edate And Eomonth Functions Youtube

How To Calculate Your Net Worth Net Worth Financial Calculator Savings Bonds

Early Retirement Calculator Spreadsheets Budgets Are Sexy

5 Best Retirement Calculators Which Are Totally Free Financial Freedom Countdown

The 3 Best Free Retirement Calculators Can I Retire Yet

Monte Carlo